Angel Investing in Perspective

May 15, 2018

The role emotions play and the biases that they can create are especially important to try to keep in check when Angel Investing.

To try to manage these biases:

- Set a personal capital budget to invest

- Set portfolio targets

- Percentage of total assets

- Number of investments

- Amount of cash in reserve (dry powder)

- Average amount per investment

- Select an investment Style – e.g Value Investing or Momentum

- Frame up the activities you want to focus on – E.g. Difficult to review 200 companies and sit on 20 boards

- What is your Personal goal/motivation for angel investing?

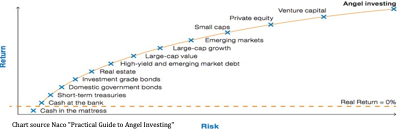

Comparing Market Volatility/Returns and Angel Investing

The Dow’s best day was a gain of 11.08% (Oct. 2008) while the worst day was a loss of 22.61% (Oct. 1987). This is a wide range for possible returns into which any given future day may fit. Downside for Angel investing is 100% loss.

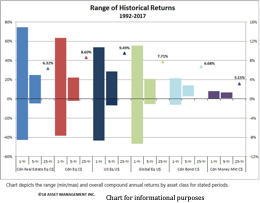

Moving away from daily returns, the chart below shows the expected range of returns for 1-year and 5-year periods plus actual 25-year returns.

The risk/return profile is very different from an Angel Investment. None of these examples show a chance of a 100% loss of capital.

Most Angels make 90% of their returns from 10% of their investments.

No more than 10-15% of your total investment portfolio should be available for Angel investing is a general opinion.

Angel investments usually need to hold for 3 – 8 years. Some Angel investors have had an average hold of 14 years prior to exit.

Most common advice for good risk management is to hold at least 20 companies or augment a smaller number of direct investments with an Angel fund.

To diversify your portfolio risk further you could consider industry sectors, development stage, geographic location and the number of co investors.

Another sound approach would be to first ensure that all your family needs are satisfied with secure investments, and then make the remainder available for Angel Investing.

Always remember. Don’t allow yourself to get caught up in the excitement of the deal and don’t allow the amount of money you invest to be unduly influenced by how much money other people are investing in a deal.

Set your limits and stick to them!

Source of Information NACO book “A Practical Guide to Angel Investing” and 18 Asset Management Inc.