What Makes Angels Invest?

June 19, 2019

Top 5 Ways Angels Evaluate Start-ups

By: Bernie Batt

Angels can be motivated by different things when developing investment strategies. While there isn’t a one-size-fits-all solution, there are five effective methods to evaluate an investment.

1. Growth Ramp

Growth ramp is by far the easiest way to eliminate a company as a potential investment. For Angels, the vast majority of investments fail to provide a return. As a result, in order to offset those losses, investments must have the possibility of being vastly successful. If the company does not have the market potential to grow rapidly and cost effectively, it will not attract the attention of many Angels. Some focus on companies that can become “unicorns”: companies with valuations in excess of a billion dollars. Alternatively, some focus on companies with smaller growth potential, but lower strategic risk.

2. Entrepreneurial Readiness

The entrepreneur is one of the most important factors when deciding whether to invest in a business, but it is not always an easy thing to gauge. All entrepreneurs are future-oriented, optimistic, and risk-taking. Unsurprisingly, the investment strategy depends on the individual and what they see as the biggest risks, and what motivates them as an Angel.

The size of the leadership team can also be a factor. Multiple founding partners can diversify the risk of a single entrepreneur fizzling out. Some Angel investors won’t invest in companies with a single entrepreneur. Alternatively, some will not invest in companies with more than three founders, as larger founding teams can be at odds with accountability. Some Angels create a rule set to manage strategic risk including the number of founders, the founder’s age, experience, and industry, and these can differ vastly between Angels.

I measure entrepreneurial readiness by looking for passion, persistence, and resourcefulness. I look for an unparalleled understanding of the market and the resources they need and how to utilize them.

3. Product-Market Fit

Even with a stellar entrepreneur, if the company does not have a market, it cannot grow. Product-market fit is the concept that a product fills a void where customers have demand.

There are two key challenges with assessing product-market fit in young companies:

A) If the company is very early stage, they won’t know if a product-market fit exists.

In this case, an Angel can gain comfort around product-market fit if the entrepreneur is prepared to test their product assumptions. Personally, I look for entrepreneurs who can design tight feedback loops to quickly revise their early product.

B) With a blue ocean strategy, a company crEates a new market.

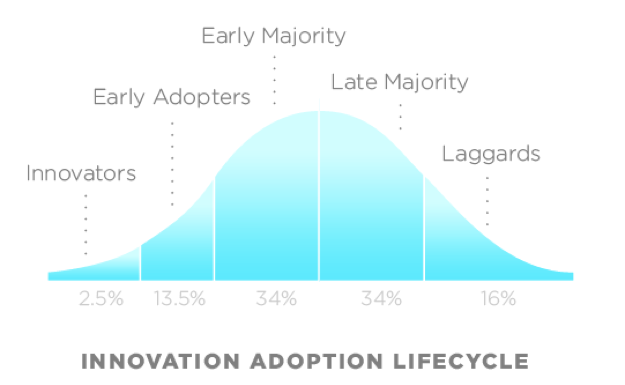

Before AirBNB existed, I had no desire to rent out a stranger’s home. Early adopters were adventurous couch surfers. I was in the early majority because I am a tech savvy, frugal millennial with a family that fits better in a basement suite than a small hotel room. In this case the demand was a variation in an inexpensive short-term housing option underserved by traditional hotel models. Angels gain comfort if entrepreneurs understand their target markets at various stages in the product life cycle.

4. Strategic Risk

Some Angels’ decisions rely heavily on a company’s strategic risk. A company that doesn’t manage its risk will quickly result in losses or failure to attain their goals.

- Product risk: if the product still needs to be developed or requires its first customers

- Competitive risk: maintaining patents appropriately, and effectively protecting trade secrets can help insulate a company from competition

- Reputational and legal risk: When companies don’t sufficiently protect their customers from physical, emotional, or financial harm a company can lose customer trust or become entangled in lawsuits

5. Deal Structure

Deal structure can be the most important part of the Angel decision-making process. Some Angel requirements include:

- Clauses that reward founders for a long and successful commitment

- Instrument (preference can vary):

- Preferred shares and common shares crystallized the valuation when the deal is signed

- Convertible debentures and safe agreements for protection

- Guarantee of ability to steer the company – Board of Directors representation and/or specific voting rights allow Angels to formalize their role in guiding the company

- Clauses with favourable governance terms including down round protection, ability to invest in follow on rounds, and drag along/tag along rights

With this glimpse into the process of start-up evaluation, is your entrepreneurial team ready to pitch? Learn more about the criteria for an Angel investment and start your application today.